BOJ Trims COVID-19 Funding Aid But No Policy Normalization in Sight

The Bank of Japan on Friday decided to trim its COVID-19 funding support for big firms as their financing conditions have improved but were in no hurry to move toward policy normalization without accelerating inflation, in contrast to its U.S. and European peers.

With the discovery and spread of the Omicron variant of the novel coronavirus adding a layer of uncertainty over its economic impact, the BOJ decided at a two-day policy meeting to keep its ultraloose monetary easing steps unchanged.

Surging inflation that came with an economic recovery and supply bottlenecks has prodded the U.S. Federal Reserve to signal three rate hikes in 2022 and made the Bank of England the first central bank among the Group of Seven industrialized nations to raise interest rates this week.

The European Central Bank is taking a more cautious approach to dialing back emergency stimulus.

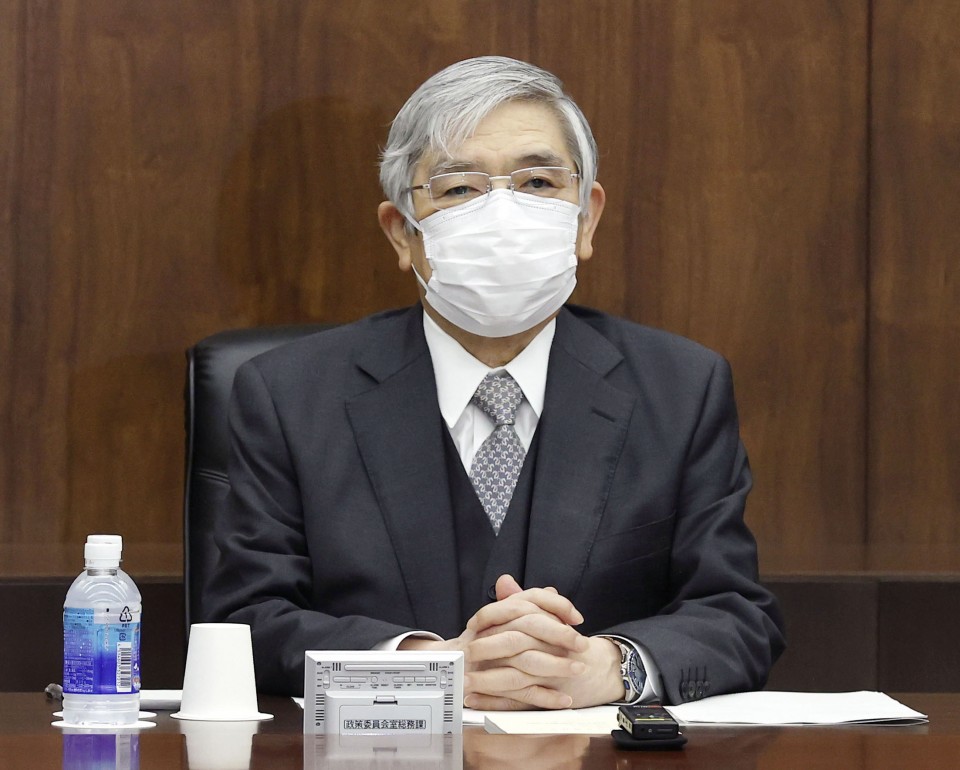

“It’s true that inflation expectations have been rising a bit,” Governor Haruhiko Kuroda told a press conference after the policy meeting. “There may be upside risks (to the inflation outlook) but the situation will be far from those in the United States and Europe.”

“We are not likely to make moves toward policy normalization” like the U.S. and European central banks, Kuroda said, with the BOJ’s 2 percent inflation target still unattainable.

The divergence of policies among central banks is natural because economic conditions are different and the BOJ’s policy stance will not be immediately affected by other countries’ policies, the BOJ chief said.

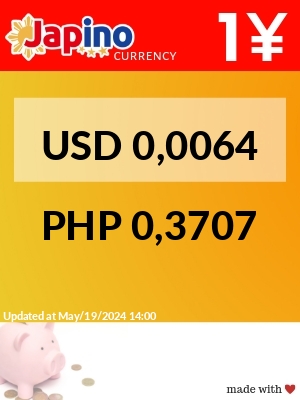

As widely expected, the BOJ said it will continue to set short-term interest rates at minus 0.1 percent, while guiding 10-year Japanese government bond yields around zero percent. It will buy exchange-traded funds with an upper limit of 12 trillion yen ($106 billion).

Changes were made to the BOJ’s COVID-19 funding support program to buy commercial paper and corporate bonds issued by large firms with a combined limit of 20 trillion yen and to provide cheap funds to financial institutions extending loans to struggling smaller firms.

From April, the BOJ will gradually reduce its commercial paper and corporate bond purchases to the pre-pandemic levels of around 2 trillion yen and 3 trillion yen, respectively.

A six-month extension to September of the fund provision to struggling small and midsize firms is meant to give “reassurances” to companies in need, Kuroda said.

Wholesale prices have surged due to higher energy and raw material prices with the impact magnified by a weaker yen. Consumers are gradually feeling the pinch from higher gasoline and kerosene prices and some companies, especially in the food industry, have decided to raise prices. But Japanese firms are cautious about immediately passing on such costs to consumers.

The relatively slow and limited pass-through comes at a time of weak consumer demand and tame wage growth, bolstering the case for the BOJ to retain its accommodative policy for an extended period.

Based on the BOJ’s projections, the core consumer price index, which rose only 0.1 percent in October from a year earlier, will likely increase 0.9 percent in fiscal 2022 beginning in April.

“We can’t say just because prices are rising, it’s good. It’s desirable for both wages and prices to increase,” Kuroda said.

Prime Minister Fumio Kishida is stepping up calls for companies to raise wages as part of his drive to achieve wealth redistribution and economic growth.

The lifting of a COVID-19 state of emergency nationwide on Oct. 1 has led to more economic activity, a relief to service providers who have lagged in the recovery from the pandemic fallout. The recovery remains uneven between manufacturers and nonmanufacturers, with smaller firms seen facing more difficult funding conditions.

“Japan’s economy has picked up as a trend, although it has remained in a severe situation due to the impact of COVID-19 at home and abroad,” the BOJ said, sticking to its previous assessment.

Analysts say a potential depreciation of the yen in tandem with the Fed’s entry into a rate hike cycle will likely come into focus in the months ahead.

A weak yen is a mixed bag for Japan as it boosts the overseas profits of Japanese companies when repatriated but it also inflates import costs for energy, food, and other items.

For now, Kuroda sees more benefits from the yen’s weakness to the economy than negatives.

“Monetary tightening or rate hikes in the United States and Europe won’t necessarily lead to a weaker yen. Even if the yen weakens a bit, it will rather be positive for the economy under current conditions,” the BOJ chief said.

Yoshimasa Maruyama, chief economist at SMBC Nikko Securities Inc. expects the dollar to rise to around 116 yen and 117 yen from the recent 113 yen levels after the Fed goes ahead with a rate hike, probably in the April-June quarter.

“If the BOJ can expect the (core) CPI to rise 2 percent, say next year, a rate hike can be justified. But it’s not insight and the CPI may rise 1 percent next year, which may be its peak,” Maruyama said.